Stock Trading Via Control-Theoretic Methods with Suggestions for Research and Applications

Abstract

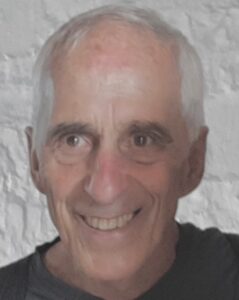

Prof. B. Ross Barmish, Emeritus Professor, University of Wisconsin, Madison, USA

B. Ross Barmish is currently an Emeritus Professor of Electrical and Computer Engineering (ECE) at the University of Wisconsin, Madison, where he previously served as a full-time faculty member from 1984 to 2019. In addition to his academic activities, his consulting company, Robust Trading Solutions, LLC, concentrates on stock trading problems which are of interest to practitioners.

From 2019 to 2023, he held an appointment as Research Professor at Boston University. From 2001 to 2003, he served as Chair of the EECS Department at Case Western Reserve University while holding the Nord Endowed Professorship. Earlier in his career, he held full-time faculty positions in engineering at the University of Rochester (1978-1984) and Yale University (1975-1978). He received his bachelor’s degree in Electrical Engineering (EE) from McGill University and the M.S. and Ph.D. degrees, also in EE, from Cornell University.

Throughout his career, Professor Barmish has served the IEEE Control Systems Society in many capacities and has been a consultant for a number of companies. He is the author of the textbook “New Tools for Robustness of Linear Systems” and is a Fellow of both the IEEE and IFAC for his contributions to robust control. He received two consecutive Best Journal Publication Awards, each covering a three-year period, from the International Federation of Automatic Control and has given many keynotes and plenary lectures at major conferences. In 2013, he received the Control Systems Society Hendrik W. Bode Lecture Prize for “fundamental contributions to the analysis of systems with parametric uncertainty and to probabilistic robustness, and for contributions to the design of stock-trading algorithms that are robust to market variability.” Associated with this award, he delivered a plenary to 1000+ conference attendees at the 2013 IEEE Conference on Decision and Control in Florence, Italy.

While his earlier work concentrated on robustness of dynamical systems, over the last decade, his research has focused on building a bridge between feedback control theory and real-world trading in complex financial markets.